By Admin

The Undeniable Importance of General Insurance

General insurance refers to non-life insurance policies designed to protect against risks such as health emergencies, property damage, accidents, and liabilities. Unlike life insurance, which focuses on life coverage, general insurance addresses a wide spectrum of tangible and intangible assets, offering peace of mind in a world full of uncertainties.

Types of General Insurance:

Health Insurance: Covers medical expenses, ensuring quality healthcare without financial stress.

Motor Insurance: Protects vehicles against damage, theft, and third-party liabilities.

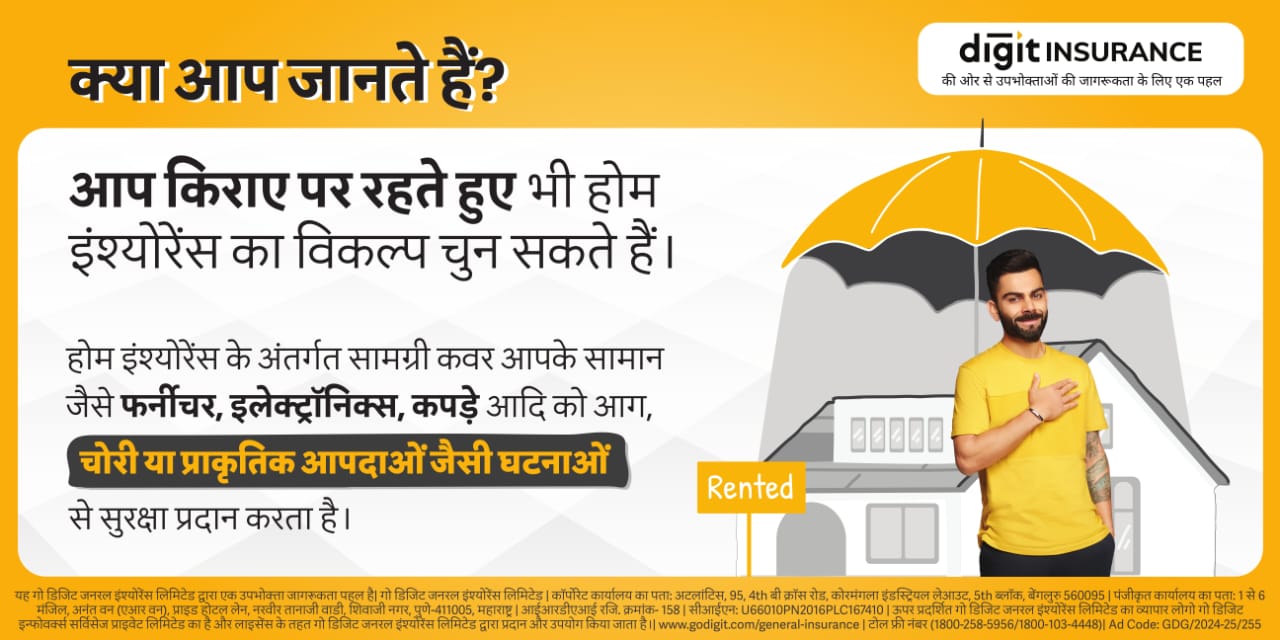

Home Insurance: Shields your home and belongings from natural disasters, theft, and accidents.

Travel Insurance: Offers financial security against mishaps during domestic or international travel.

Commercial Insurance: Safeguards businesses against property damage, liability claims, and operational risks.

Why is General Insurance Important?

1. Financial Security in Crisis:

Life is unpredictable, and crises like accidents, natural disasters, or medical emergencies can strike at any time. General insurance ensures that such incidents don’t drain your savings, offering a financial cushion to help you recover and rebuild.

2. Legal Compliance

Certain types of general insurance, such as motor insurance, are mandatory under law. Failing to have adequate coverage can lead to legal penalties, making compliance not just a responsibility but a necessity.

3. Peace of Mind

Knowing you’re protected against unexpected events reduces stress and allows you to focus on other aspects of life or business without constant worry.

4. Risk Management for Businesses

For businesses, general insurance is a cornerstone of risk management. It protects against potential liabilities, property damage, and operational disruptions, enabling businesses to sustain growth even in adverse conditions.

5. Encourages Savings

By covering substantial expenses that arise from accidents, health issues, or damages, insurance prevents you from dipping into your savings, ensuring financial stability in the long run.

Benefits of General Insurance

Customizable Coverage: Tailored policies meet specific needs, whether personal or commercial.

Tax Benefits: Certain premiums, like health insurance, qualify for tax deductions.

Fast Claim Process: Modern insurers offer streamlined claim settlements, reducing downtime after an incident.

Access to Quality Services: Health insurance policies often include access to top-tier healthcare providers, ensuring better treatment options.

How to Choose the Right General Insurance Policy.

Assess Your Needs: Identify potential risks in your life or business that need coverage.

Compare Policies: Use online tools to compare features, premiums, and claim processes.

Check the Insurer’s Reputation: Look for customer reviews, claim settlement ratios, and service quality.

Understand the Fine Print: Ensure clarity on exclusions, coverage limits, and terms before purchasing.

Conclusion

General insurance isn’t just an expense; it’s an investment in your peace of mind, financial stability, and future. Whether it’s protecting your health, home, vehicle, or business, the right insurance policy ensures you’re prepared for life’s uncertainties. By securing your assets and reducing financial burdens, general insurance acts as a powerful tool to help you navigate life’s challenges with confidence.

So, take the step today—choose the right general insurance plan and empower yourself to face the future fearlessly.